Nurturing for Scale

An illustration of a seedling growing into a mature forest

I hear phrases like “we need more high-quality nature-based solutions!” and “we need the next generation of high-quality projects in the Voluntary Carbon Market!” all the time. I hear it from leading carbon buyers, in the headlines of carbon news outlets, and certainly in rousing conversations on LinkedIn. Building those next generation nature-based solutions (NBS) projects not only takes a lot of planning and diligent execution, but it also takes capital; upfront capital, to be precise. This upfront capital pays for critical early-stage project development activities like: recruiting landowners into improved forest management (IFM) and afforestation, reforestation, and revegetation (ARR) projects, developing forest management plans, taking forest inventories, buying and planting trees, providing payments to landowners, and validating the project under a recognized carbon standard. All activities that ensure a carbon project generates high-integrity credits and transformational impact on the planet.

Now, in a perfect world, developers of high-quality NBS projects could hop on a Zoom call with their preferred bank to begin an ideally straightforward process of securing a loan to pay for the early-stage project development activities noted above. Unfortunately, we aren’t living in a perfect world…yet. Debt financiers still see the carbon markets as nascent, with a lot of risk and low liquidity. This leaves carbon projects with financing gaps, putting them at risk, and ultimately hindering the scaling of positive climate impact. AFF has been exploring other options that give projects the necessary earlier stage funding and give funders more assurance about their investment.

Learn how AFF is innovating how we finance and scale carbon markets at affauction.org

So how do we fund projects in a way that more effectively meets the needs of buyers, developers, and the planet? Well, there are two primary options as of right now, 1) project equity finance, and 2) buyer pre-payment contracts. In general terms, project equity finance is where capital is provided by an investor to the project in exchange for a percent ownership of the project, or in many cases, a percent ownership of the future cashflows. The investor receives the lion's share of the cashflows until they hit their target return, at which point there is usually a flip, and the project begins to receive a greater share of the cashflows. This is a great way to finance early stage projects; however, the only catch is that if you are to hit the investor’s target percent return, which can range anywhere from the mid-teens to mid-thirties, buyers need to be willing to pay much higher prices for high-quality NBS projects than they currently are. We are talking in the range of $100-$250/tonne for high-quality, US-based NBS projects using a dynamic baseline.

Until there is a clear and sustained demand signal for high-quality NBS credits in those price ranges, it will be difficult to make project equity finance pencil out, particularly for US-based projects that have higher cost structures. This again puts projects at risk and slows the pace of development, and climate impact. The positive news on this front is that some developers have successfully financed projects using project equity finance, particularly in tropical regions where trees grow faster. Additionally, the Symbiosis Coalition recently launched their ARR RFP, which will likely rely on project equity finance to capitalize the early-stage projects they are seeking. This will require higher price points to be paid by the coalition buyers and will be a major market signal to keep an eye on.

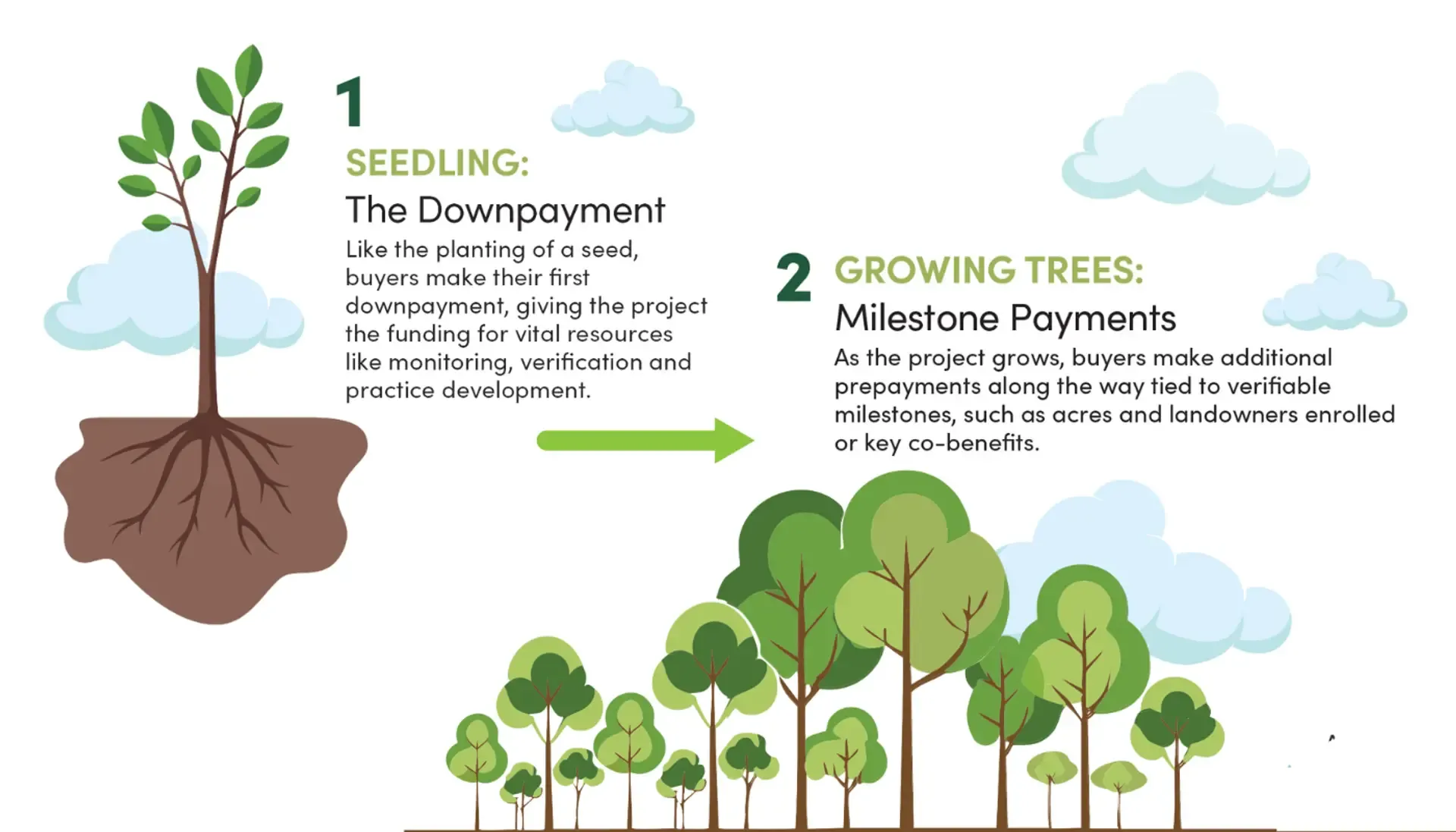

That leaves us with buyer prepayments, and the American Forest Foundation is focused on a new version that more effectively ties prepayments to tangible impact: milestone prepayments. Milestone prepayments are where a buyer prepays for future carbon credits via a payment schedule tied to a series of project development milestones. For an early stage ARR project, the project milestones might include acreage enrollment, tree planting, project validation and verification, etc. The milestones would be appropriately calibrated to the project type, its unique development plan, and timeline. This importantly de-risks the payment for the buyer because it is based on project development progress being actually achieved.

An illustration of a down payment (seedling) turning into project milestones (trees)

To use an analogy, imagine you are having a new house built. It is typical for a general contractor to require a downpayment to begin working on the house. The downpayment allows the general contractor to buy materials and contract with other sub-contractors, ultimately catalyzing the building process for your new house. However, it would be inappropriate for the general contractor to ask you for the payment for putting the roof on the house when the foundation hasn’t even been poured. The same holds true for carbon projects: milestone payments should be based on material project development stages. A downpayment for an ARR project, for example, allows the project to begin recruiting landowners and making deposits for the future purchase of seedlings. This upfront capital is necessary to begin the development of the new carbon project, and subsequent milestone payments are tied to development milestones being achieved. Which aligns incentives for all parties and provides the necessary capital to the project at the right time, enabling development, scale, and impact throughout the life of the project.

Milestone prepayments are an effective way to get early-stage financing to high-quality NBS projects, payments are made as progress is achieved, it brings the buyer closer to the project and development process and secures future high-quality NBS credit supply, and in AFF’s case, we offer significant discounts off future market prices for pre-payment contracts. It does require buyers to use budget dollars they have today in order to secure a high-quality stream of credits in the future. This is a real consideration for buyers to contend with, but I would remind us of what we are trying to solve for: “we need more high quality NBS projects!” Across the different funding mechanisms, milestone prepayments offer the VCM the most viable financing structure to unlock the next generation of high quality NBS projects.

An illustration showing the final credit delivery (forest)

That is why at the American Forest Foundation we are focused on milestone prepayments to catalyze and sustain our high quality IFM and ARR projects. We recently executed our first milestone prepayment contract for our Fields & Forest ARR project with an excellent corporate partner (more on this soon!) and are launching the American Forest Foundation Carbon Auction, which will use milestone prepayments to finance the next phase of scale in our IFM projects in the Family Forest Carbon Program. Whether you are a buyer or a project developer, we invite you to visit affauction.org to learn more about the auction and how milestone prepayments can catalyze and scale high quality NBS projects.

Register for the first auction for Family Forest Carbon Program credits at affauction.org. With milestone prepayments, the American Forest Foundation Carbon Auction provides the Family Forest Carbon Program the essential upfront funding to deliver measurable and verifiable impacts in the fight against climate change.