The Journey of a Philanthropic Dollar

Philanthropy has a tremendous opportunity in carbon projects. The world is facing multiple environmental, economic and social challenges: climate change, the loss of biodiversity, freshwater shortages, and the slow degradation of rural economies, to name a few. Our natural world can contribute to alleviating all of these problems and the carbon market is one of our most effective tools to leverage this potential.

However, carbon projects often need a kick start, in the form of critical early-stage financing and ideally from partners who prioritize not only generating returns but also achieving all the conservation, climate and social impacts nature can offer. That’s where philanthropy comes in. Philanthropy of all kinds—individual donations, planned gifts, corporate contributions or foundation grants—can achieve transformational impacts by providing funding for natural climate solutions, and specifically to early-stage carbon projects. And yet, despite its potential to address multiple challenges, relatively few philanthropists, companies, or foundations are engaged in the space.

While carbon projects offer tremendous opportunity, they are also extremely complex, and the market through which they operate—the carbon market—is both complicated and new to many donors.

In this blog post, we try to demystify carbon projects and show how donors can catalyze their impact by contributing to them. These opportunities exist across many different types of carbon projects, but we will be focusing on the ones we know best—forest carbon projects.

To dive deeper, watch a recording of our recent webinar: The Journey of a Philanthropic Dollar: An Inside Look at Forest Carbon Projects.

RenewWest’s Jenny Hellman, AFF Board Member and Founder of Convene Communications Strategies, Scott Deitz, and I walk attendees through how upfront philanthropic investment plays an essential role in creating healthier forests. I share more details on the journey of a carbon project and how philanthropic funding impacts each stage, giving projects the time and critical resources to succeed.

What is a forest carbon project and why are such projects important?

Forest carbon projects and the developers who manage them provide education, technical assistance and advice, and financial resources to an owner or manager of forest land, in order to help them understand and implement better land management practices. Over time, that results in a healthier forest that produces many forest values, including additional carbon sequestration and storage, better habitat for wildlife, and improved retention and filtration of water. They also include economic opportunities for small family landowners and rural communities, such as direct payments from the project, higher quality timber supplies, and improved soil quality for farming.

Despite the multiple values that are enhanced through a quality carbon project, in many cases the project developer is able to monetize only one: carbon. The difference between the carbon sequestered and stored through the project is compared to the carbon that would have been stored without the project, and the difference can be used to create carbon credits, once verified by third-party auditors under internationally recognized standards. Each credit represents one tonne of carbon dioxide that has been kept out of the atmosphere. Such credits are purchased by companies and other organizations that are seeking to take responsibility for their own greenhouse gas emissions as they themselves seek to reduce those emissions heading forward.

So, problem(s) solved, right? Corporations can just buy carbon credits, and that funds all this great work, right?

Unfortunately, it’s not that simple, and the complexities of building, implementing and growing a forest carbon project are full of challenges. Or, from the perspective of a philanthropic donor, opportunities for impact.

The two basic challenges

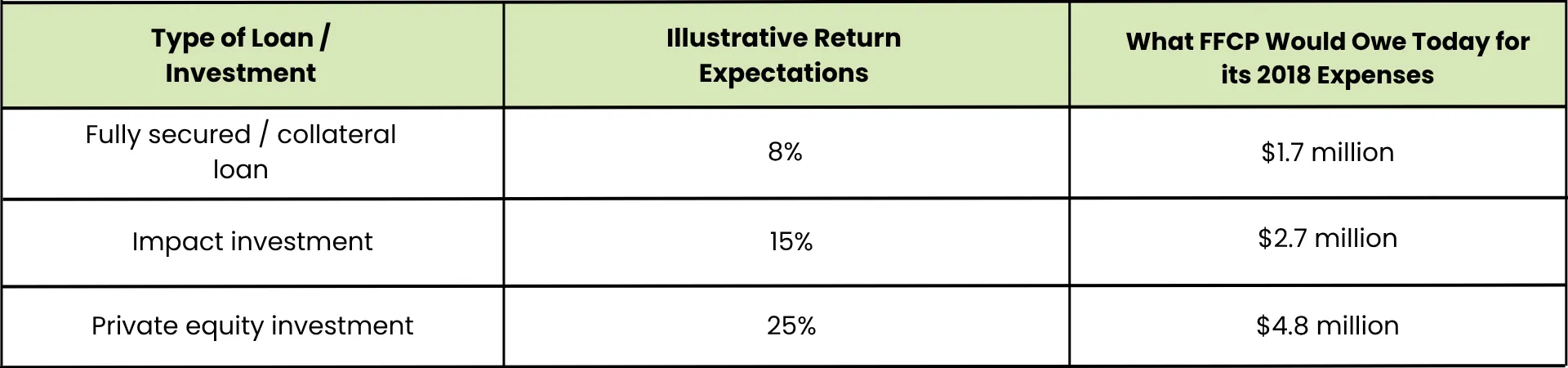

The first challenge to forest carbon projects is that it takes time to research, design and implement a forest carbon project. Then, once you have implemented it, it takes yet more time for photosynthesis to do its job and remove CO2 from the atmosphere. And then yet more time to measure, report and verify the results. And finally, even more time to sell, issue and deliver the credits. If the project developer borrows money from others, or accepts money from investors who expect a certain rate of return, the amount they owe back grows every year due to the magic of compounding interest. Because of the long time between initiating a project and creating and selling credits, this can result in an impossible financial burden for the project.

For example, the Family Forest Carbon Program kicked off in 2018 with approximately $1 million in research and development costs, which we were able to secure through a mix of contributions from the U.S. Natural Resource Conservation Service, the Doris Duke Charitable Foundation, the VF Corporation, and in-kind contributions from the American Forest Foundation and The Nature Conservancy. We are on track to issue our first credits in 2025—seven years later.

From first investment to final credit delivery, 7 years is the typical lifecycle for high-quality natural climate solutions. If the Family Forest Carbon Program hadn’t received those philanthropic contributions and instead borrowed money or accepted investment, we would have owed a sizable sum, a sum that would be challenging to repay and would divert financial and technical resources from smallholder landowners. Today, FFCP invests millions in rural communities in the form of direct payments and tangible resources—an investment that is possible thanks to our philanthropic partners.

A Breakdown on Types of Investment and Return Expectations

The second challenge, which interacts powerfully with the first, is that while these projects have tremendous potential, they also have risks that need to be considered and mitigated. Today, the Family Forest Carbon Program is a thriving and growing program currently available across 19 states and in our journey from an idea to fully functioning program, there were several roadblocks that could have delayed or deter our growth.

The risks for carbon projects include:

-

After an initial research period, it turns out the project is not viable.

-

The project can’t be implemented as envisioned – maybe they can’t recruit enough landowners, for example.

-

The project doesn’t produce as much credits as anticipated – a very real risk for high quality projects that seek to precisely measure the difference “the atmosphere feels,” something that can only be done after the fact and which might yield results different from what was initially projected. This risk in particular pressures many project developers to take shortcuts in their carbon accounting.

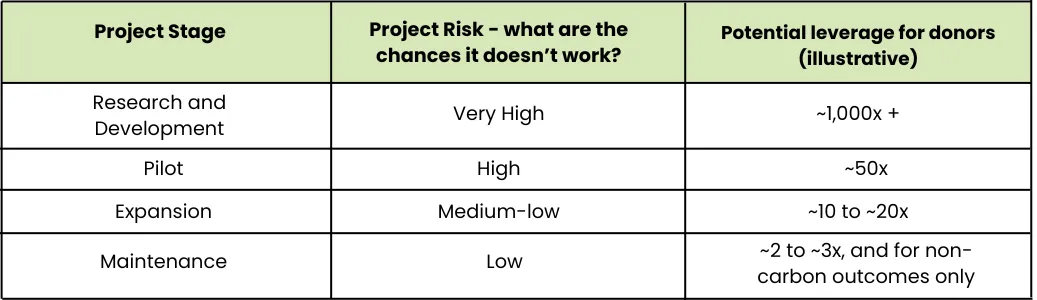

As the risk associated with a project goes up, the financial return that lenders and investors expect goes up—which makes the time between project initiation and credit issuance more costly, which in turn injects more risk, which in turn increases the cost of time delays, and so on and so forth. Many high-quality projects have entered this “death spiral” and collapsed as a result.

Impact of Philanthropy

Why should a philanthropic donor contribute to a carbon project as opposed to, say, a traditional grant program supporting healthy forests? In both cases your donation is having an impact, so why bother with all the complications of the carbon market?

The answer is simple: leverage. In a traditional forest conservation program, donors must give for every outcome the program produces, year after year. In a forest carbon project, philanthropic funds contributed can catalyze or “crowd in” much more substantial amounts from lenders, investors and buyers.

To use the Family Forest Carbon Program as an example, we project that for every 6 cents contributed through donors or grants, 94 cents will come from lenders, investors or carbon credit buyers. In this case, the impact of every philanthropic dollar would be multiplied by almost sixteen times through leveraging the emerging carbon markets.

And for donors who support carbon projects from the very beginning, the leverage can be much higher. AFF projects that our original donors (those who gave us that initial $1 million in 2016) could ultimately achieve a 1,500x multiplier on their donation. Meaning, each dollar they contributed could end up catalyzing $1,500 in other investments in the outcomes they are interested in. But they also took a leap investing in our work, a step that philanthropy is uniquely positioned to take.

The opportunity to leverage philanthropic dollars is immense. If you’re a donor looking to have an impact on climate, nature, or rural communities, you need to learn about carbon markets and the ways you or your foundation can shape them and grow them.

And more importantly, as donors, conservation leaders, and people who deeply care about our planet, I hope you explore the potential carbon market offers. By partnering with carbon projects, your investment can catalyze the critical impacts for our forests, rural communities, and natural world.