What is the Permanence Trust? A Look at a New Solution for Nature

Natural Climate Solutions (NCS) are an essential tool in mitigating climate change and protecting the health of our planet, but they are often questioned for the credibility of their impact claims. A critical aspect of high integrity NCS projects in the voluntary carbon market is the ability to ensure that the credits they produce are permanent, meaning that emissions that these credits are meant to offset can capture and store those emissions permanently. Current approaches to permanence have attempted to solve this challenge, but none have been entirely successful. The American Forest Foundation’s recent publication, A Trust For Permanence: Enabling a New Generation of Permanent Nature-Based Credits in the Voluntary Carbon Market, explores a new approach to the permanence problem. Let’s take a look at how it works.

What is permanence, and why does it matter?

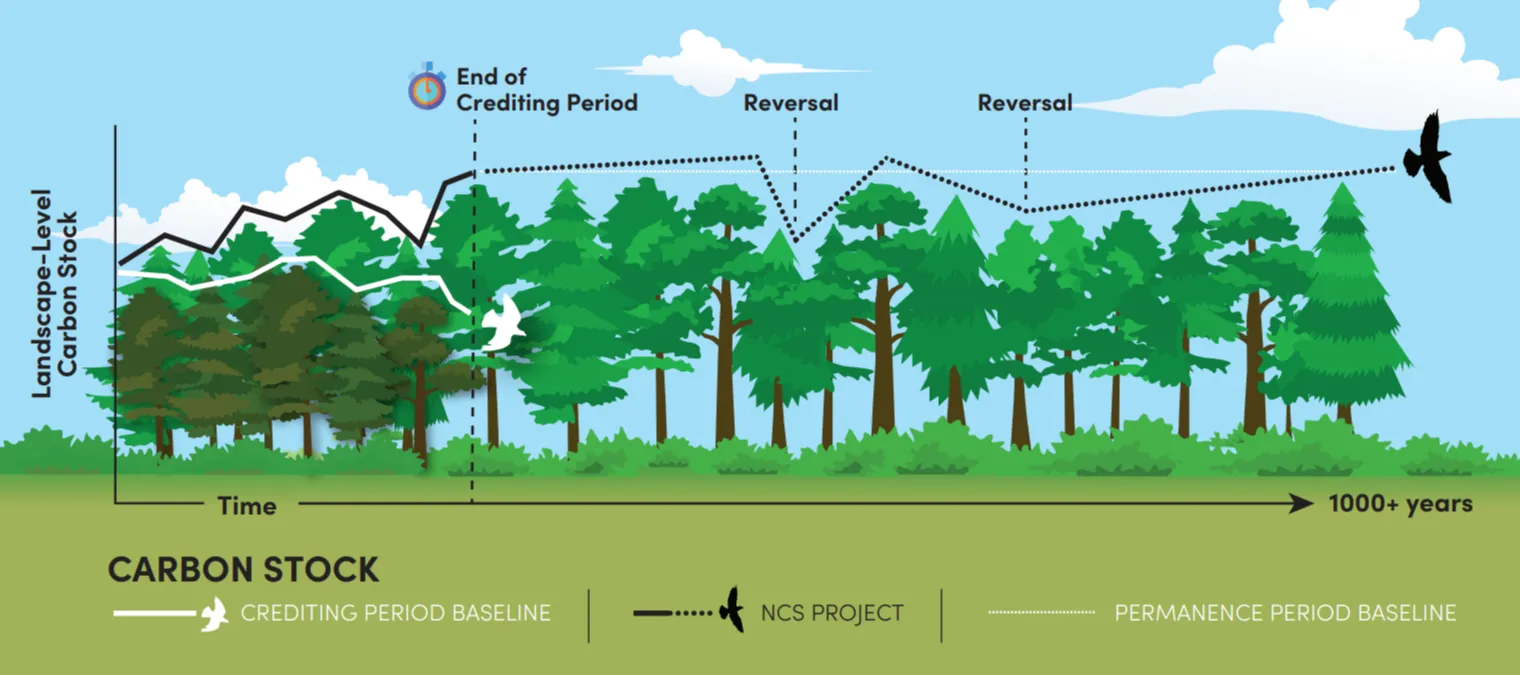

The concept of permanence is critically important to define, measure, and predict. But to date, there exists no market-wide agreed upon definition or method to measure it. A broad definition that can be applied to all scenarios for permanence is the carbon benefit, removal or reduction, of an intervention, carbon project or practice, persists within the atmosphere for the required length to be deemed as permanent removal.

When buyers purchase a carbon credit to offset their unabated emissions, there is an assumption that those carbon credits are a true and permanent representation of the removal or reduction of those emissions. Overall market credibility depends on accurately predicting permanence, because buyers will not want to buy a credit if they cannot confidently assume they are truly addressing their impact on the atmosphere. This makes addressing permanence incredibly important to the overall effectiveness and trust in NCS projects in the fight against climate change.

A key part of assessing permanence is evaluating how likely it is that the carbon storage from a given project or practice will be undone by a reversal. A reversal occurs if at any time during the permanence period, the credited carbon stock in a project falls below the project’s baseline plus credited gains, causing the stored carbon to be re-released into the atmosphere. Though there is significant climate-mitigating potential for NCS, they generally have a high risk of reversal. Concerns regarding this risk have led to an explosion of interest in technological innovations that remove CO2 or other greenhouse gases from the atmosphere and store them in geologic reservoirs. These projects, while having much lower reversal risk and increased confidence in their permanence, are extremely costly.

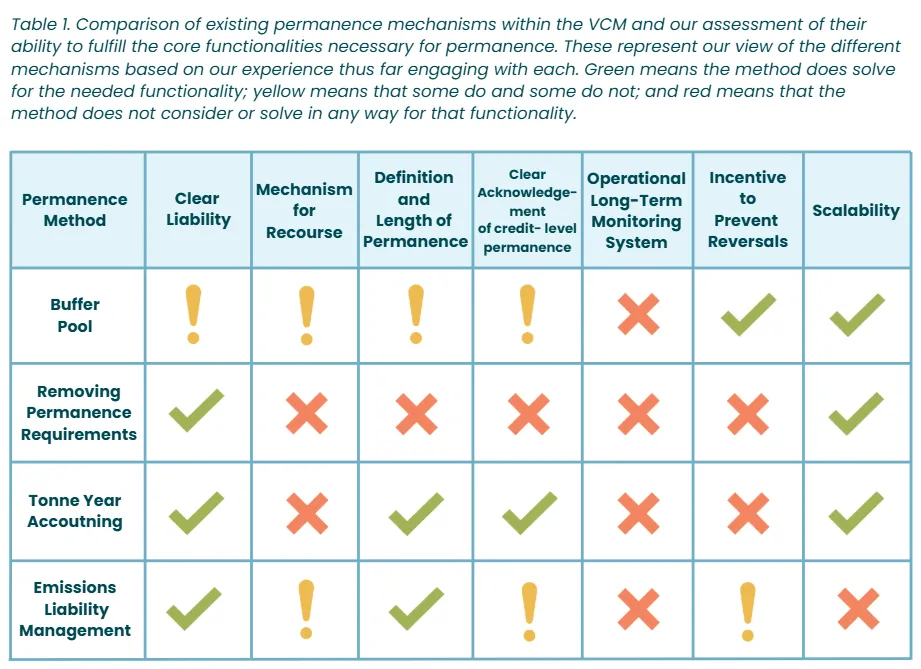

While there have been many attempts at managing permanence for NCS projects, none have completely solved this complex problem. The table below outlines the successes and shortfalls of current approaches.

A New Solution: The Permanence Trust

The American Forest Foundation has created an innovative new approach that aims to fill all the core functionalities necessary for permanence: The Permanence Trust. This approach frames non-permanence as a risk to be managed, strengthens market-wide definitions and risk management strategies, and provides a framework that allows NCS credits and other carbon credit types (like geologic storage) to be managed together, increasing overall market confidence and credibility.

Unlike previous methods, the Permanence Trust would be a new entity in the carbon market that relies on models that suggest how many financial resources should be set aside today to grow and be actively used to manage non-permanence risk. The Trust would be responsible for managing the resources set aside from multiple projects and project types through the collection of liability fees, similar to an endowment. In exchange for this fee, the Trust would assume the liability for monitoring the persistence of credited climate benefits, manage efforts to reduce risk of reversal, and compensate for any reversals of climate benefits after the periods required by the relevant standards have ended. Through this approach, the Permanence Trust uses pooled financial reserves and long-term liability management to backstop NCS credits with the option of more permanent geologic storage credits.

What makes the Trust different?

The Trust offers a solution to non-permanence risk that addresses many of the common pitfalls of current approaches.

The Trust serves as a solution through:

-

Shared liability: the Trust pools both collective risk and resources, increasing access for participation across all project types and sizes

-

Resource access and innovation support: the Trust provides resources to invest in innovation within the carbon market, and manages actions to reverse the storage of existing climate benefit

-

Long-term monitoring of carbon: the Trust’s operations incorporate financial support of long-term monitoring systems

-

Mechanisms for recourse and reversals: instead of trying to predict the future of reversals, the Trust instead ensures that any reversal is replaced by another temporary credit, addresses interim gaps through insurance, and ultimately retires liability by purchasing a removal credit backed by geologic storage.

-

Increased market confidence and scalability: The Trust provides a framework for comparing carbon credit types across the market, operationally unifies definitions and measurement methods for permanence, and ensures NCS credits deliver the same durability as other permanent credit types such as geologic storage.

-

Resource growth and reinvestment: Fees generated through carbon credit sales are pooled together and grown both through and after the Credit Liability Period, generating long-term funds that can be reinvested in monitoring, risk reduction, and replacement of carbon storage when needed.

-

Shift from passive to active permanence assurance: The Trust shift permanence assurance from a passive approach of holding reserves that may or may not cover future reversals to an active strategy that funds prevention, monitoring, and replacement of future reversals to ensure long-term durability of carbon.

What do we need to implement a Permanence Trust?

Establishing a market-wide entity is no easy task, and there are many challenges that need to be solved for the Permanence Trust to get off the ground.

Building Recognition and Demand

The Trust will only succeed if it is recognized by carbon standards and buyers. Alignment with standards like Verra, Gold Standard, or Article 6.4 will ensure that Trust-backed credits are accepted and tradable. At the same time, market uptake requires convincing buyers that these NCS credits are trustworthy and equivalent to geologic storage.

Designing a Durable and Trusted Institution

In our view, the permanence of NCS has a significant bearing on the public good. Since so much of the Trust’s effectiveness depends on distributing risk as widely as possible, there are advantages to creating a single, market-wide Trust. The Trust must last for 1,000 years or more, which creates unique governance and legal hurdles. It needs a structure that is transparent, credible, and able to endure across generations, jurisdictions, and political changes. Designing a durable institution that stakeholders will trust and invest in is essential.

Achieving Sufficient Capitalization for Solvency

The Trust must assume and maintain enough money to meet its obligations for an extended amount of time. The Trust’s model for estimating key variables—such as the rate of return on investments, the future cost of carbon removal with storage, and the carbon decay rate of participating projects—might be incorrect. As a result, the Trust might be unable to cover the liabilities generated by removals. However, the concept of insolvency does not quite apply to the Permanence Trust in the same way it would apply to other financial institutions. Suppose in any given year, the Trust cannot address its “balance” of physical liabilities by purchasing carbon removal with geologic storage. In that case, it can simply wait until its financial reserves recover to retire the liability. Even if it encountered periods of temporary “insolvency,” it would be a material improvement over the status quo.

Establishing a Shared Definition for Reversals

A clear, shared definition of what counts as a reversal is needed so that the Permanence Trust can act consistently across all projects. The Trust exists to retire permanence obligations for reversals through the purchase of carbon removal with geologic storage, so a widely agreed-upon definition of a reversal that enables them to be monitored and reported with little to no ambiguity is necessary for the Trust to function.

Long-term Monitoring

The Permanence Trust will only function if the carbon stocks underlying carbon projects can be accurately and cost-effectively monitored after the project ends. This ensures that reversals are identified and addressed and that feedback is provided on how the Trust can most effectively mitigate future reversals by identifying changing risks. This requires institutional continuity and robust methods for tracking carbon storage long-term.

It is important to note that none of these can be addressed without robust coordination and participation among stakeholders across the carbon market.

Making the Trust a Reality

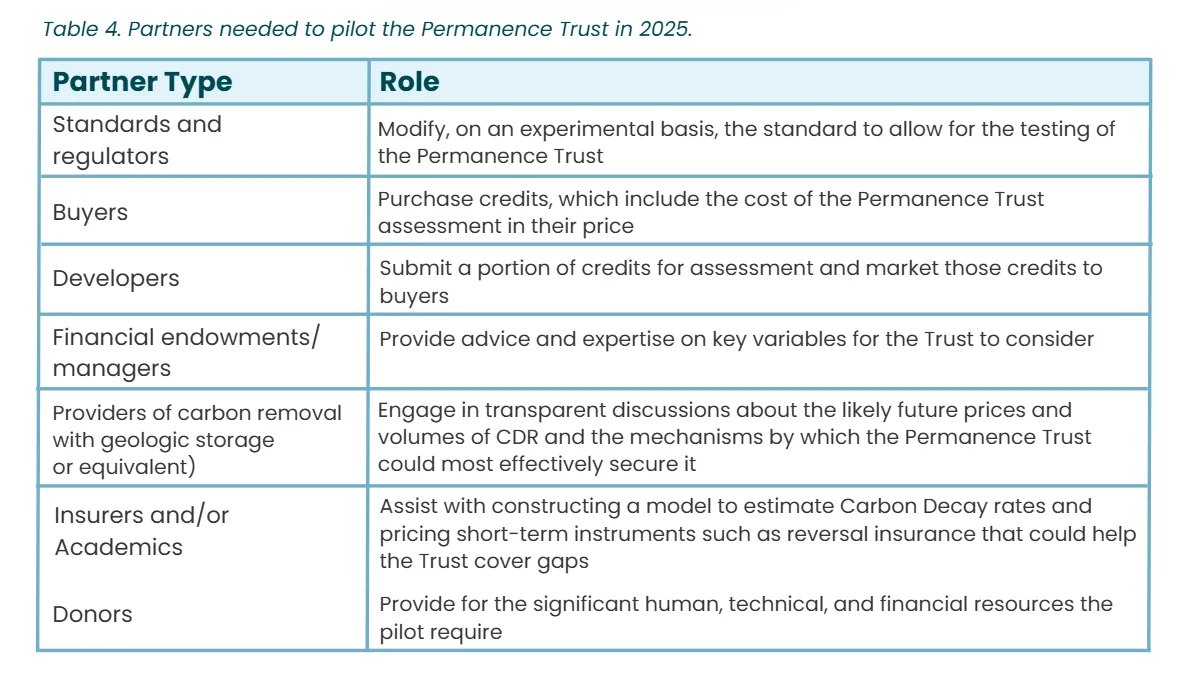

Every stakeholder has a role to play to develop and practically implement an entity like the Trust. AFF’s concept paper details these roles in the below chart:

But to know if this Trust will work, we need to put it to the test. AFF has been in close coordination with partners, stakeholders, and resource providers to develop a plan to better understand what it would take for the Trust—or an iteration of the proposed concept—to successfully and sustainably address non-permanence risk for NCS projects.

Nature is our strongest and most accessible mechanism to immediately address the impacts of climate change we have today. While technological methods continue to evolve, it is critical that market stakeholders leverage every tool to make nature work for us now.

Interested in learning more about the Trust? Email Kristina Hughes at khughes@forestfoundation.org to get involved.

Related Articles

January 15, 2026

2026 American Forest Foundation National Leadership Conference

The American Forest Foundation’s National Leadership Conference brings together leaders, family forest landowners, and advocates from across the country for meaningful connection, learning, and collaboration. The conference is designed to empower participants to strengthen conservation impact on family forest lands, whether on their own property or through work with family forest landowners.

December 18, 2025

Improving Wildlife Habitat with the Family Forest Carbon Program

For many landowners, spotting a fox, songbird, or other wildlife on their property is one of the highlights of spending time on their land. In this post we look at some examples of management practices you may see in your FFCP forest management plan and how they help create the ideal conditions for certain wildlife species.

December 16, 2025

Family Forest Carbon Program's First Ever Credits Delivered to REI Co-op

Today, REI becomes the first buyer to receive carbon credits from the Family Forest Carbon Program (FFCP), a high-integrity forest carbon project designed for small-acreage landowners.