Why Voluntary Carbon Markets Are a Smart Investment for Companies Tied to Forests and Water

Extreme weather events are intensifying across the U.S.—from wildfire to prolonged drought and flooding—and our forests are often at the center of these impacts. While these challenges ultimately affect everyone, certain industries increasingly face direct, material exposure to these effects—but they also have unique tools to reduce that risk.

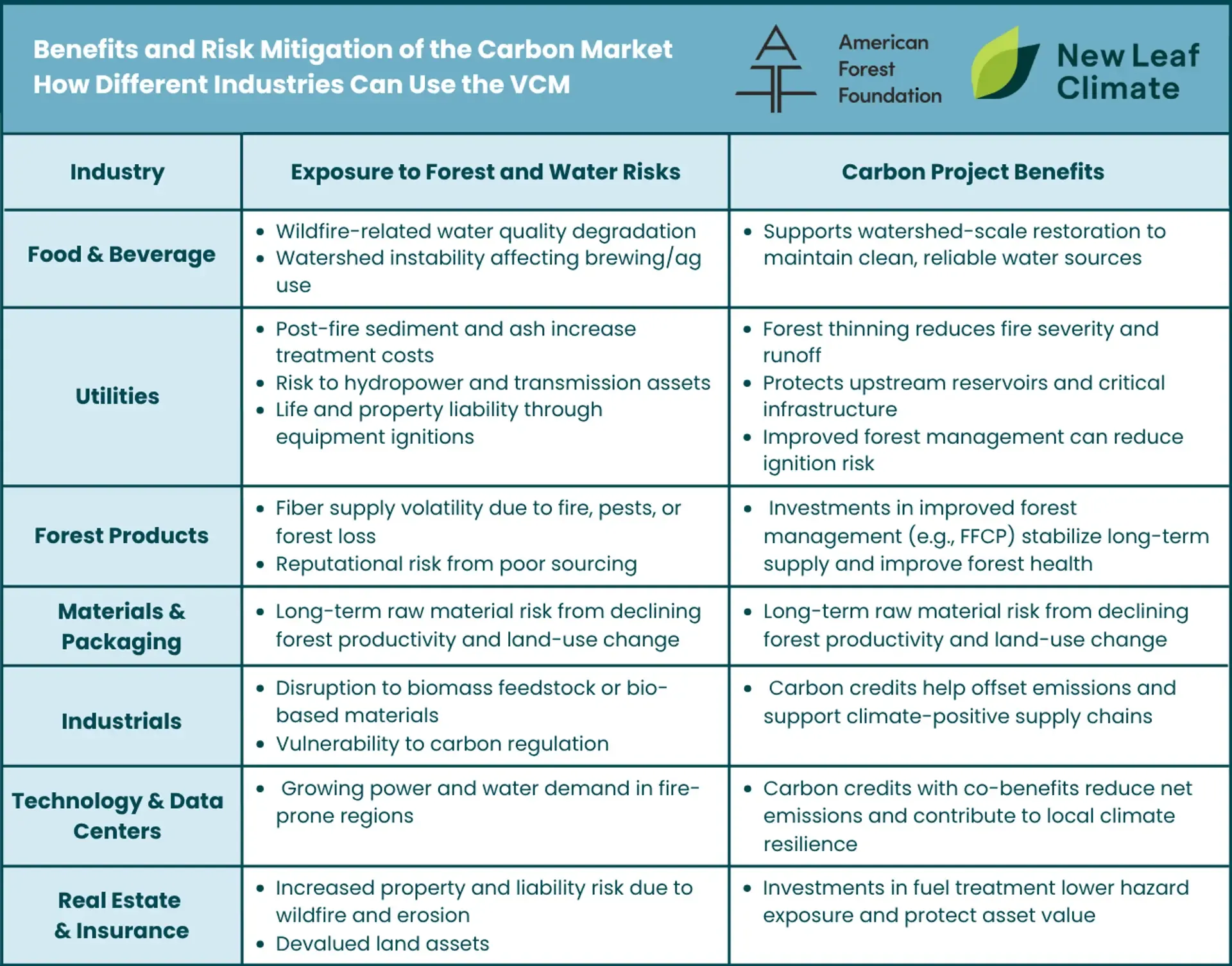

Companies in food and beverage, utilities, industrials, technology, forest products, and materials sectors are especially vulnerable. These businesses depend on healthy forests and watersheds to deliver stable supply chains and clean water. Yet the landscapes they rely on are becoming degraded, under-managed, and exposed to climate volatility.

Voluntary carbon markets—once viewed primarily as a corporate sustainability lever—are now emerging as a powerful risk management tool for these industries. With new science-backed methodologies and regional-specific risk mitigation programs, voluntary carbon investments provide an efficient project financing mechanism that can help companies protect and restore forests and watershed landscapes, thereby reducing their physical and operational risks.

The Business Dimensions of Forest Risk

The business case for forest investment is grounded in place-based risk. For example, half of all surface water in the conterminous United States originates in forested areas, and 89% of public water suppliers rely on these forests for at least part of their supply. Smart investments into forest and watershed health and restoration can substantially reduce risk and shore up upstream supply of critical materials. Consider:

-

Western U.S.: Megafires are decimating carbon stocks and watersheds. A single fire can destroy properties and infrastructure and result in ash and erosion that threaten drinking water and emit millions of tons of CO₂ in the process. Utilities, consumer staples and industrials face rising treatment costs, infrastructure damage, and legal liability.

-

Southeastern U.S.: Home to much of America’s working forestlands, the Southeast faces growing challenges with conversion of forests, invasive species, water pollution, and increasingly erratic weather patterns. For materials companies and pulp and paper suppliers, fiber security and diversification of supplier inputs is at risk through increasing hurricane risks, invasive pests and loss of working forestland.

-

Northeast and Upper Midwest: Aging forests and land fragmentation threaten long-term productivity. Without viable management economics, many landowners may sell or convert forestland—jeopardizing water quality and impacting Materials and Industrials companies' inputs.

Importantly, these risks do not abide by strict property lines – that is, climate impacts know no human boundary; wildfires, droughts and pests extend across jurisdictional lines – therefore companies need to be engaged across broader landscapes to reduce their risks. The risks vary by industry and region—but the throughline is clear: without investment in forest resilience, climate volatility will disrupt the systems businesses rely on.

Turning Risk into Opportunity Through Carbon Markets

Carbon markets today are more than compliance tools—they are established mechanisms to invest in the resilience of landscapes that underpin businesses. By supporting forest carbon projects with clear ecological and economic co-benefits, companies can:

-

Reduce operational and infrastructure risk from wildfire, water volatility, and ecosystem degradation

-

Secure long-term access to wood, fiber, and clean water—key inputs for industrial production

-

Enhance ESG performance with verifiable, U.S.-based carbon credits and co-benefits

-

Strengthen stakeholder trust and regulatory positioning through nature-positive investments

Through purchasing carbon credits or developing carbon projects that are strategically aligned with core operational business exposures, companies can effectively reduce risk and secure offset benefits via emissions accounting.

From Forest Risk to Business Resilience

The science is clear. The risk is growing. And the mechanisms to act are here.

For companies that rely on forests—whether for water, materials, or ecosystem stability—the opportunity is not just to offset carbon, but to invest in resilience. It’s now business critical.

Read More

At New Leaf Climate Partners, we’re developing the Forest Landowner Support for Wildfire Reduction (FLS) program in California – a new carbon program that incentivizes wildfire mitigation via fuel treatment. By thinning overstocking forests in high-risk areas, these projects prevent megafire-scale emissions and protect water, biodiversity, and local economies.

The American Forest Foundation is scaling the Family Forest Carbon Program (FFCP) across multiple U.S. regions. This Verra-approved methodology compensates landowners for long-term forest stewardship, ensuring enhanced carbon storage, clean water protection, improved biodiversity, and sustainable rural livelihoods.

Related Articles

March 27, 2025

The Business Case for Carbon Credits: How Reducing Emissions Increases Revenue

Sustainability Isn’t Just a Nice-to-Have. It’s Good Business. A company that demonstrates progress on decarbonization is going to be more likely to meet customer and consumer expectations, and therefore secure revenue, than a company that is unable to demonstrate such progress.

January 30, 2025

The Business Case for Carbon Credits: The Hidden and Visible Costs of GHG Emissions

In the first half of 2025, AFF is going to outline the business case for companies to decarbonize and purchase and retire high-integrity carbon credits to address their unabated emissions. We will kick it off by talking about the financial benefits of decarbonization more broadly. A company that can more quickly reduce emissions throughout its value chain is a company that will be more profitable and resilient in the coming decades.

December 18, 2024

The Business Case for Carbon Credits

Today, the American Forest Foundation is launching a series designed to provide companies a comprehensive and easily understandable answer to the question, “What is the business case for purchasing and retiring carbon credits on the voluntary carbon market?”