The Permanence Trust

An innovative approach to tackling risk in carbon crediting

The Permanence Problem

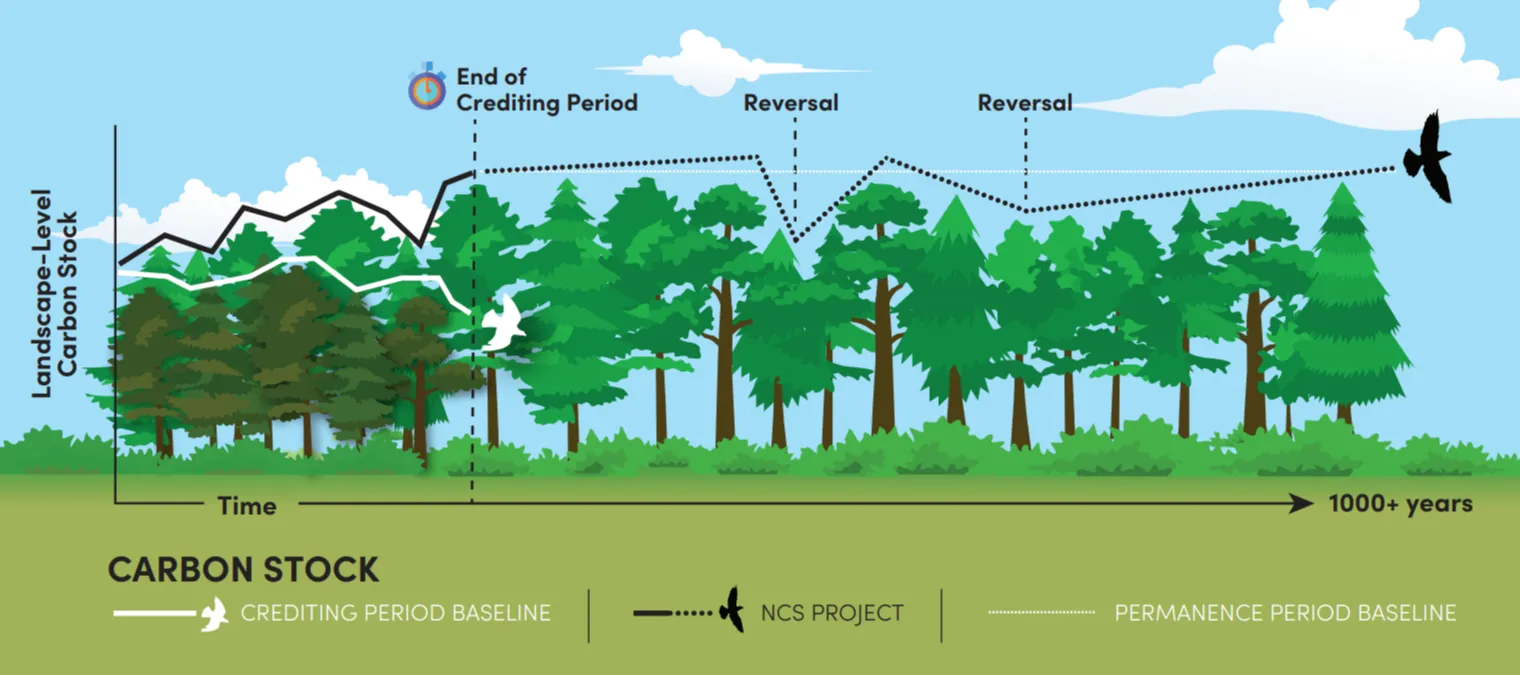

Natural climate solutions (NCS) are an essential tool in mitigating climate change and protecting the health of our planet, but they are often questioned for the credibility of their impact claims. A critical aspect of high integrity NCS projects in the voluntary carbon market is the ability to ensure that the credits they produce are permanent, meaning that emissions that these credits are meant to offset can capture and store those emissions permanently.

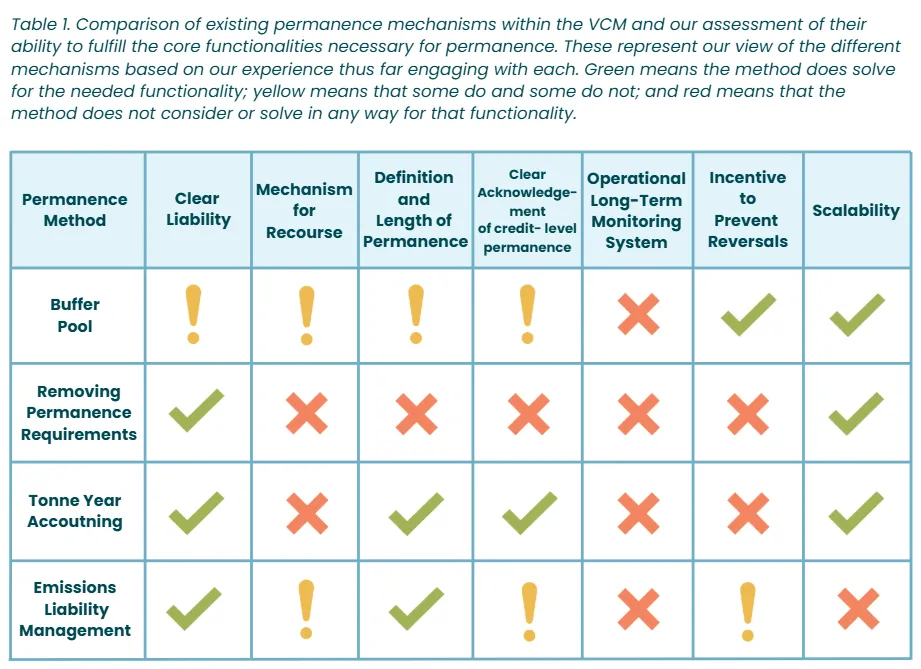

To date, there is no universal approach to addressing non-permanence risk in carbon projects. Existing efforts like emissions liability management, buffer pools, and tonne-year accounting have made significant progress in increasing the credibility of projects, but none of them provide a complete set of solutions that address the complexity of the problem.

The Permanence Trust: A Solution for Nature

The American Forest Foundation has created an innovative new approach that aims to fill all the core functionalities necessary for permanence: The Permanence Trust. This approach frames non-permanence as a risk to be managed, strengthens market-wide definitions and risk management strategies, and provides a framework that allows NCS credits and other carbon credit types (like geologic storage) to be managed together, increasing overall market confidence and credibility.

Read AFF's full concept paper on the Permanence Trust here

What Makes the Permanence Trust Different?

The Trust pools both collective risk and resources, increasing access for participation across all project types and sizes.

The Trust provides resources to invest in innovation within the carbon market, and manages actions to reverse the storage of existing climate benefit

The Trust’s operations incorporate financial support of long-term monitoring systems

Instead of trying to predict the future of reversals, the Trust instead ensures that any reversal is replaced by another temporary credit, addresses interim gaps through insurance, and ultimately retires liability by purchasing a removal credit backed by geologic storage.

The Trust provides a framework for comparing carbon credit types across the market, operationally unifies definitions and measurement methods for permanence, and ensures NCS credits deliver the same durability as other permanent credit types such as geologic storage.

Fees generated through carbon credit sales are pooled together and grown both through and after the Credit Liability Period, generating long-term funds that can be reinvested in monitoring, risk reduction, and replacement of carbon storage when needed.

The Trust shift permanence assurance from a passive approach of holding reserves that may or may not cover future reversals to an active strategy that funds prevention, monitoring, and replacement of future reversals to ensure long-term durability of carbon.

Putting the Trust to Work: Feasibility Study

While the Permanence Trust is promising as a concept, it remains only theory until practically applied. That's why AFF has partnered with carbon insurance specialist Kita to conduct a feasibility study.

The study includes framework development, stakeholder engagement, and risk modeling for the Trust. This involves entity structure and design, financial planning, reversal risk assessments, carbon portfolio management, and mapping loss recourse options.

The study is supervised by an Advisory Group of experts across the climate, carbon, and conservation spaces to gather valuable and diverse input into the assessment framework. Advisory group members contribute expertise through two focused working groups: Methodology, and Financial & Legal Governance.

Permanence Trust Advisory Group Members

Kristina Hughes, American Forest Foundation

Lynn Riley, American Forest Foundation

Nathan Truitt, American Forest Foundation

Richard Campbell, American Forest Foundation

Racheal Notto, Kita

Simon Schultheis, Agreena ApS

Kyle Hemes, Amazon

Janet Peace, Anew

Richard Rheingans, Appalachian State University

Ingeborg Mägi , Arbonics

Amy Duval Carlson, Arbor Day Foundation

Spencer Meyer, BeZero Carbon

Lucyann Murray, Boston Consulting Group

Rachael Ross, Carbon Direct Inc

Peter Fegelman, Carbon Markets Research

Noah Deich, Carbon180 / RMI

Lyuba Tarnopolsky, CarbonPool

Jennifer Larkin, Chaco Vivo

Chris Williams, Clark University

Chetan Aggarwal, Climate Spring

Molly Tinker, Climeworks

Chris Woodall, CTrees

Sassan Saatchi, CTrees

Serge Bushman, DuraVault

Holly Pearen, Environmental Defense Fund

Hannah Robinson, Equitable Earth

Lucas Clay, Georgia Institute of Technology

Fiona Perera, Gold Standard

Mikela Waldman, Integrity Council for the Voluntary Carbon Market

Max DuBuisson, Indigo Ag

Christopher Kilner, Isometric

Sheldon Zakreski, Living Sky Carbon Solutions

Maria Huyer, Mast Reforestation

Ben Santhouse-James, McKinsey

Dan Harburg, Mombak

Moriz Vohrer, naturebase

Lauren Frisch, Netflix

Michael Kent, New Leaf Climate Partners

Carlos Silva, Pachama

Freddy Cushnir, Ponterra

Victor Reyes, Ponterra

Jonathan McGillivray, Resilient LLP

Matt Kirley, RMI

Kyle Clark-Sutton, RMI

Jennifer Jenkins, Rubicon Carbon

Janis Dubno, Sorenson Impact Institute

Edward Mitchard, Space Intelligence

Peter Mayer, Stairs Dillenbeck Finley Mayer PLLC

Connor Nolan, Stanford University

Derik Broekhoff, Stockholm Environment Institute

Dee Yang, Systemiq

Rishi Das, Terraformation

Josh Burke, The Grantham Research Institute at the London School of Economics

Susan Cook-Patton, The Nature Conservancy

David Antonioli, Transition Finance

Alexander Dhond, University of Oxford

Liz Guinessey, Verra

Giulia Carbone, World Business Council for Sustainable Development

Learn more and get involved!

Resources

September 17, 2025

Carbon Market Stakeholders Launch Feasibility Study, Advisory Group on New Permanence Framework

The American Forest Foundation announced today the launch of their partnership with carbon insurance specialist Kita to conduct a design and feasibility study for a new system-wide approach to addressing permanence for carbon markets.

September 5, 2025

What is the Permanence Trust? A Look at a New Solution for Nature

The American Forest Foundation has created an innovative new approach that aims to fill all the core functionalities necessary for permanence: The Permanence Trust. This approach frames non-permanence as a risk to be managed, strengthens market-wide definitions and risk management strategies, and provides a framework that allows NCS credits and other carbon credit types (like geologic storage) to be managed together, increasing overall market confidence and credibility.

May 28, 2025

New Report Details Innovative Approach to Permanence for Natural Climate Solutions

The American Forest Foundation released today “A Trust for Permanence: Enabling a New Generation of Permanent Nature-Based Credits in the Voluntary Carbon Market,” a new concept paper that details an innovative approach to ensuring the quality and integrity of credits produced through natural climate solutions (NCS).

November 12, 2024

New White Paper Sets Bar for Quality in Forest Carbon Projects

This week, the American Forest Foundation, a nonprofit organization that empowers family forest owners to create meaningful conservation impact, released its latest white paper, “Catalyzing Forest Carbon Project Quality: Addressing Issues of Integrity in Improved Forest Management Carbon Projects." The paper discusses the common challenges that IFM projects face in the voluntary carbon market and details four key elements the Family Forest Carbon Program (FFCP) focuses on to ensure high quality: additionality, permanence, leakage, and social integrity.