Loan Guarantees to Help Scale Carbon Projects for Small Forest Holders

Capitol Hill has been buzzing with conversations, hearings, and round tables on how rural America can help address climate change. One such opportunity is via carbon markets for small forest holders.

Across the U.S., the largest portion of forests are owned by families and individuals in small parcels between 20 and 1,000 acres. For these small forest owners, carbon markets provide a voluntary avenue for action, rather than a regulatory approach. And, like timber markets, signal the value in keeping their forests as forests.

More importantly, carbon markets help landowners overcome cost barriers, allowing them to bring in income from their land that helps them implement improved management practices that they would normally not be able to afford.

The good news is that carbon markets are growing. Mark Carney, chief of the private sector Taskforce for Scaling Carbon Markets, has pointed out that voluntary carbon markets will need to scale 15-fold to meet growing demand fueled by net-zero pledges made by companies. This demand and the dollars associated with carbon credits could be channeled to family and individual forest owners.

But with the private sector interest in carbon markets, can’t these carbon markets expand and reach small landowners on their own? Why does the federal government need to get involved?

While forest carbon projects exist and are growing, the vast majority are on properties of 5,000 or more acres. Less than 1% of the current forest carbon projects are on smaller forested properties. This is due to high upfront enrollment costs.

The good news is, unique and credible private carbon programs designed specifically for family forest owners are beginning to surface. The Family Forest Carbon Program, created by AFF and The Nature Conservancy, is one example. Unlike cost-share programs, which are the only form of government support for forest management, the Family Forest Carbon Program pays landowners upfront to implement climate-friendly forestry practices that increase carbon sequestration and storage. Then using a new methodology, measures the carbon generated in a credible, yet more landowner-friendly approach.

But such non-traditional programs for small forest owners need private capital to scale. While investors have expressed interest, there has been hesitation on such projects that are so new and have such a long lead time on impact.

Investors need risk assurance to invest their capital in green projects.

In fact, AFF, with NatureVest, engaged 25 investors and asked about the investment returns they would expect from a forest carbon project without some sort of risk assurance or credit enhancement. None of the 25 indicated a willingness to invest without a credit enhancement at an interest rate of 4%.

This is where the federal government can play a key role to leverage private sector capital and direct it to meaningful projects for small forest owners.

By providing a loan or bond guarantee for carbon projects for small forest owners, the federal government can reduce risk to investors, unlocking the capital needed for these projects to scale.

A federal loan guarantee would require minimal to no government intervention or government funding compared to opportunities it unlocks. And this is done already by the U.S. Department of Agriculture (USDA) for other more traditional commodities and rural development.

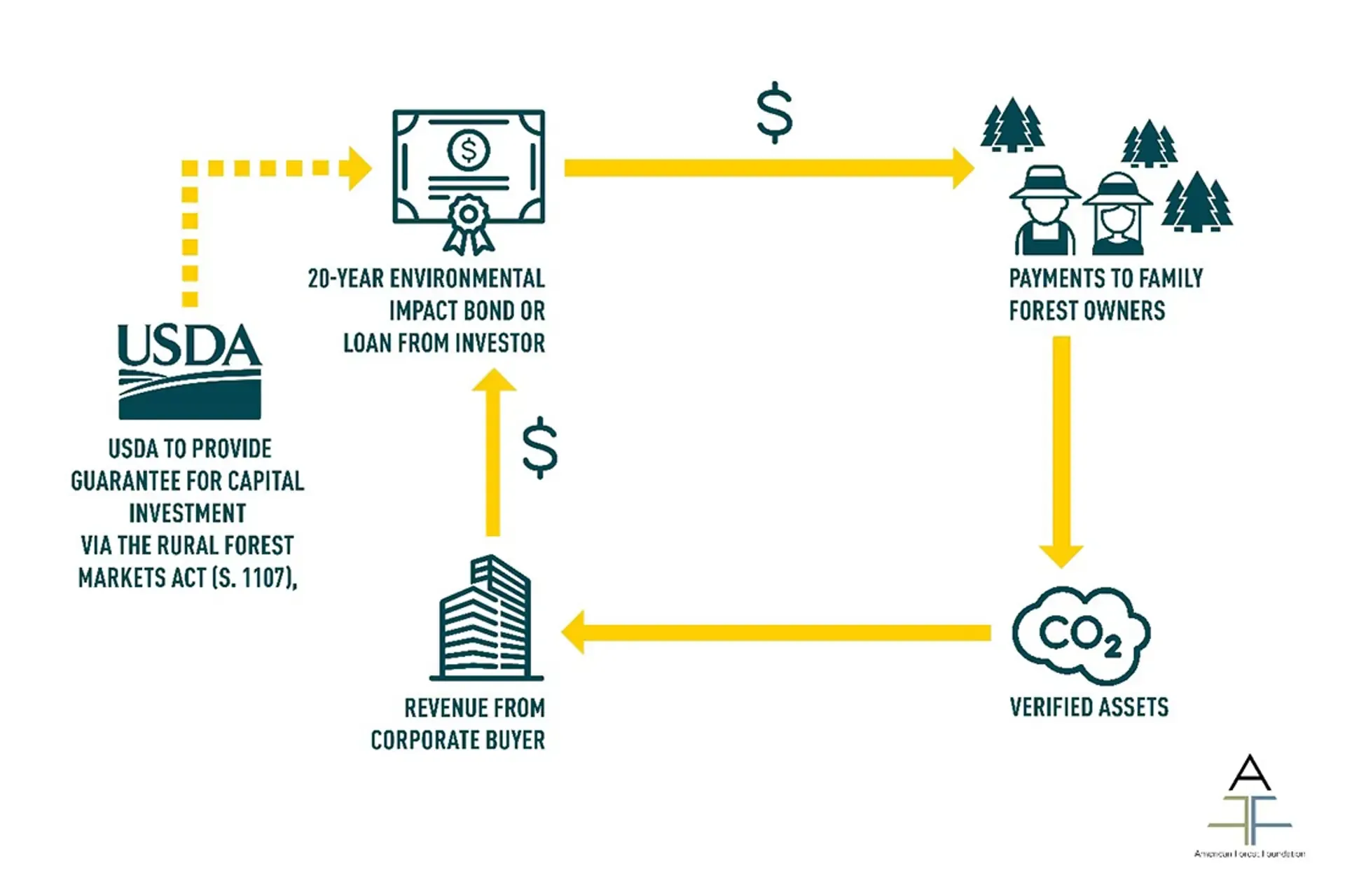

How does a loan or bond guarantee for a carbon project work?

An investor would provide a forest carbon project a loan.

The loan would be used to pay small forest owners upfront to implement climate-friendly practices that sequester and store more carbon.

Over time, those practices would generate carbon that would be sold to corporations as carbon credits.

The sale of the carbon credits would be used to pay back the investor's loan.

A loan guarantee (from the USDA) would guarantee the loan up to a certain amount, if the carbon project was, on the very small chance, unsuccessful.

This concept could be achieved via the Rural Forests Markets Act, a bill introduced by Senators Stabenow and Braun in the Senate, and Representatives Pingree and Stefanik in the House.

If you are a policymaker or staffer interested in learning more about this bill, contact us at info@forestfoundation.org.

Related Articles

February 2, 2026

AFF Statement on GHG Protocol Land Sector & Removals Standard

The exclusion of forests from the LSR Standard increases the risk of sidelining one of the most mature and impactful pathways for near-term mitigation.

January 15, 2026

2026 American Forest Foundation National Leadership Conference

The American Forest Foundation’s National Leadership Conference brings together leaders, family forest landowners, and advocates from across the country for meaningful connection, learning, and collaboration. The conference is designed to empower participants to strengthen conservation impact on family forest lands, whether on their own property or through work with family forest landowners.

December 18, 2025

Improving Wildlife Habitat with the Family Forest Carbon Program

For many landowners, spotting a fox, songbird, or other wildlife on their property is one of the highlights of spending time on their land. In this post we look at some examples of management practices you may see in your FFCP forest management plan and how they help create the ideal conditions for certain wildlife species.